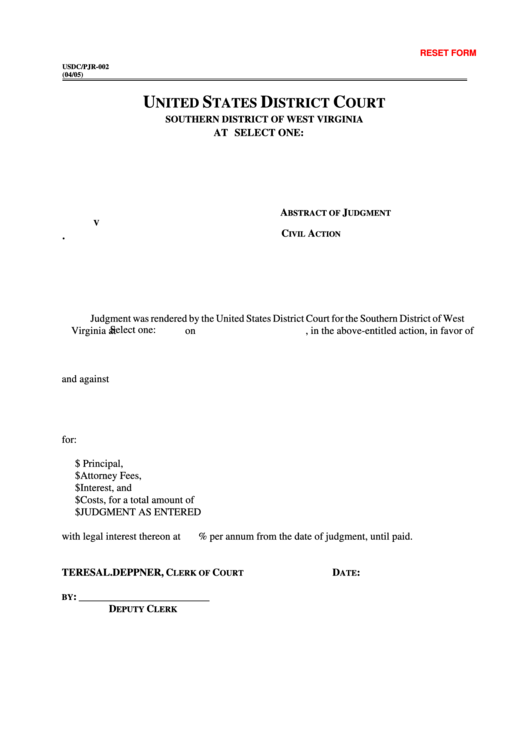

See the resources below for more information on filing a judgment lien. An abstract of judgment that has been properly indexed and recorded can be a powerful tool in the tool belt during the sometimes difficult task of collecting a judgment. Check the county clerk's website or contact their office for their current fee schedule. County clerks will require a fee in order to record this document into the property records.

Once the abstract of judgment has been issued, it may then be filed with the county clerk where the real property is located.

#ABSTRACT OF JUDGMENT TEXAS HOW TO#

If there is no form available for your justice of the peace court, you will need to contact their office for more information on how to request an abstract of judgment be issued. Unless you are represented by an attorney, the abstract of judgment must be issued by the justice of the peace court. Some of the Texas justice of the peace courts have a form to request the issuance of an abstract of judgment available on their website.

#ABSTRACT OF JUDGMENT TEXAS FULL#

To obtain the full release from the creditor you need their cooperation. You can obtain a full release of the abstract of judgment from the creditor or you can file your own partial release of the abstract of judgment as it relates to your homestead. Rules for the issuance of an abstract of judgment can be found in Section 52.002 of the Texas Property Code. Posted on Selected as best answer There are two options. To file a judgment lien, an abstract of judgment (commonly called an "AJ") must be recorded in the county where the real property is located or where property could be owned in the future. Homestead property is the most common type of exempt real property. A judgment lien lasts for ten years.Īccording to Section 52.001 of the Texas Property Code, a judgment lien cannot attach to any real property that is exempt from seizure or forced sale under Chapter 41 of the Texas Property Code. A judgment lien in Texas will remain attached to the debtors property (even if the property changes hands) for ten years. On the other hand, creditors get judgment liens as a result of a lawsuit against you for a debt that you owe. Creditors typically acquire property liens through your voluntary consent. By filing a judgment lien, if the debtor sells any non-exempt property, you may be able to get all or some of the money you are owed from the proceeds of the sale. For the most part, whether you define a lien as a 'property lien' or a 'judgment lien' depends primarily on how the creditor got the lien. One of the ways in which a creditor could attempt to collect on their judgment is by placing a judgment lien on real property owned by the debtor.

-56.jpg)

Search library website find library books hide navigation menu

0 kommentar(er)

0 kommentar(er)